One‑and‑Done Hope for Hunter Syndrome: Gene Therapy and BBB‑Smart Enzymes Ignite a New Frontier | CI Insights

From burdensome weekly Elaprase infusions to single‑dose gene therapy, the Hunter Syndrome pipeline is racing to rewrite outcomes—and expectations.

AUSTIN, TX, UNITED STATES, June 8, 2025 /EINPresswire.com/ -- Hunter Syndrome(MPS II) – Competitive Intelligence Report

Disease Overview:

Hunter Syndrome, also known as Mucopolysaccharidosis Type II (MPS II), is a rare, X-linked lysosomal storage disorder caused by a deficiency of the enzyme iduronate-2-sulfatase (I2S). The absence or dysfunction of this enzyme leads to the accumulation of glycosaminoglycans (GAGs) within various tissues and organs. This buildup results in progressive damage affecting multiple systems in the body, leading to coarse facial features, organomegaly, joint stiffness, skeletal abnormalities, and, in many cases, severe cognitive impairment. While MPS I includes three subtypes—Hurler, Hurler-Scheie, and Scheie syndromes—Hunter Syndrome specifically refers to MPS II, which typically presents in male children and follows a progressive, life-limiting course.

Download CI Sample Report: https://www.datamintelligence.com/strategic-insights/sample/hunter-syndrome-mucopolysaccharidosis-type-ii-mps-ii

Epidemiology Analysis (Current & Forecast):

Hunter Syndrome is an ultra-rare disease, with incidence rates estimated between 0.38 and 1.09 per 100,000 live male births globally. Due to its X-linked inheritance pattern, the disease primarily affects males, although carrier females can occasionally exhibit mild symptoms. Despite its rarity, the disease represents a significant clinical burden due to progressive multisystem involvement and the lack of curative treatment options.

Approved Drugs – Current Standard of Care:

The primary treatment option approved by the U.S. FDA for Hunter Syndrome is Elaprase, an enzyme replacement therapy (ERT) developed by Takeda. Elaprase is administered weekly via intravenous infusion and functions by supplementing the deficient I2S enzyme, thereby reducing GAG accumulation in somatic tissues. However, a critical limitation of Elaprase is its inability to cross the blood-brain barrier (BBB), leaving neurological symptoms largely unaddressed. Elaprase has established a strong track record in reducing somatic symptoms but does not provide cognitive improvement.

Other regional alternatives include Hunterase, an ERT approved in select markets outside the U.S., which offers a cost-effective solution with efficacy comparable to Elaprase. However, it shares the same limitation—lack of CNS penetration. IZCARGO, launched in Japan in 2021, marks a notable advancement as the first treatment to address both somatic and CNS symptoms by crossing the BBB. However, its availability remains limited to the Japanese market.

Pipeline Analysis and Expected Approval Timelines:

The therapeutic landscape for MPS II is undergoing rapid innovation, with a growing number of pipeline therapies targeting CNS symptoms—long considered the most significant unmet need in Hunter Syndrome.

One of the most promising candidates is RGX-121, a one-time gene therapy administered via a single intravenous infusion. RGX-121 uses adeno-associated virus (AAV) vector technology to deliver a functional I2S gene directly to the central nervous system. The therapy is designed to enable long-term enzyme production within the brain, potentially halting or reversing neurological decline. Regulatory approval is anticipated in the second half of 2025, depending on the success of ongoing late-stage trials.

Another innovative approach is Tividenofusp alfa, which also targets both CNS and somatic symptoms through a fusion protein designed to cross the BBB. Administered as a single IV infusion, Tividenofusp alfa may offer the advantage of significantly reduced treatment burden compared to weekly ERT. Its approval is expected between 2025 and 2026, contingent on ongoing trial outcomes.

Verenafusp alfa represents another next-generation therapy in development. Like Tividenofusp, it is designed to penetrate the CNS and alleviate both cognitive and physical symptoms of MPS II. However, it is still under regulatory review, and limited public data are currently available.

Competitive Landscape and Market Positioning:

The Hunter Syndrome treatment market is characterized by a lack of therapeutic diversity, with Elaprase dominating as the only widely available therapy. However, this is expected to change with the arrival of CNS-penetrant therapies and gene therapies.

Elaprase holds a global presence and a proven safety and efficacy record for somatic symptoms but fails to address neurological decline. Hunterase serves as a more affordable version in certain regional markets but offers no added clinical advantage. IZCARGO, available only in Japan, is currently the only therapy that improves both somatic and CNS symptoms, giving it a unique edge in that geography.

Emerging therapies like RGX-121 and Tividenofusp alfa are poised to shift the market paradigm by targeting CNS involvement—a key differentiator. Their one-time or less frequent administration also addresses the burden of weekly infusions, positioning them as strong contenders to eventually replace or complement existing ERTs.

Strategic Insights:

Among pipeline candidates, Tividenofusp alfa offers a significant clinical breakthrough due to its dual targeting of CNS and somatic symptoms, along with its potential as a one-time administration therapy. This could drastically reduce treatment burden and improve quality of life.

RGX-121, through its gene therapy approach, represents a paradigm shift with the potential for long-term, possibly lifelong benefits from a single infusion. If successful, it could redefine the therapeutic goal from disease management to functional stabilization or even reversal of symptoms.

Verenafusp alfa, though earlier in development, combines enzyme replacement with innovative CNS-targeting technology. If proven safe and effective, it may become a competitive option offering holistic symptom management.

Target Opportunity Profile (TOP):

To effectively compete with or replace existing therapies, new treatments for Hunter Syndrome must meet several key criteria:

Safety: An ideal therapy would demonstrate low immunogenicity, minimal infusion-related reactions, and good long-term tolerability. Existing ERTs like Elaprase are associated with the development of antibodies and infusion-related complications.

Efficacy: The most urgent clinical need lies in treating CNS symptoms. Emerging therapies must show significant improvements in both cognitive function and somatic symptoms. Improvements in neurocognitive measures and long-term functional stability will set these therapies apart.

Mechanism of Action: New therapies should penetrate the blood-brain barrier or enable durable gene expression. IZCARGO and Tividenofusp have shown promise in this regard. RGX-121, via AAV vector gene delivery, represents a transformative approach with long-term potential.

Route and Frequency of Administration: Weekly IV infusions, as required by Elaprase and Hunterase, are burdensome. Therefore, therapies that offer monthly or single-dose infusions, ideally administered less invasively, are highly favorable from a patient and caregiver perspective.

Technological Novelty: New transport platforms such as ETV (enhanced transport vehicles) and J-Brain Cargo® are attracting attention for their ability to deliver therapeutics across the BBB. Therapies leveraging such technologies can justify premium pricing through clear mechanistic differentiation.

Value Proposition: Given that current ERTs cost over $500,000 annually, new therapies must deliver superior or long-lasting clinical benefits to justify pricing. Demonstrating cost-effectiveness through functional outcomes, biomarkers, and health economic models will be key to market access and payer adoption.

Strategic Implications for Developers:

For biopharma companies aiming to compete in the MPS II space, the strategic imperative is clear: target the brain, reduce treatment burden, and demonstrate value. Specifically, developers should:

- Prioritize BBB-penetrating or gene therapy platforms in their R&D pipelines

- Design trials that evaluate both somatic and neurological endpoints early.

- Showcase durable improvements using robust clinical and biomarker data.

- Build strong pharmacoeconomic models to support pricing and reimbursement.

Book Your CI Consultation Call: https://www.datamintelligence.com/strategic-insights/ci/hunter-syndrome-mucopolysaccharidosis-type-ii-mps-ii

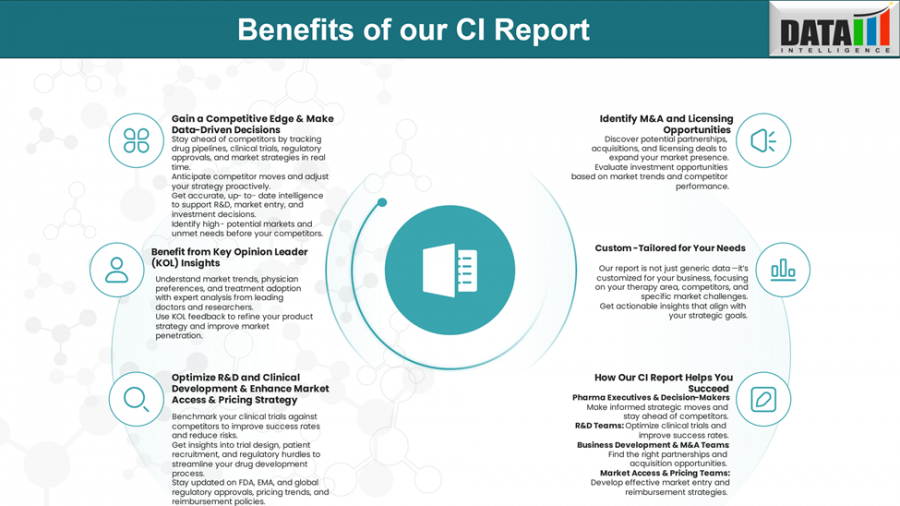

Why Buy Our Pharma Competitive Intelligence Report?

1. Gain a Competitive Edge & Make Data-Driven Decisions:

Track real-time pipeline updates, clinical progress, and strategic moves of top companies. Anticipate market shifts and inform your business development, licensing, and investment strategies.

2. Benefit from KOL Insights:

Leverage expert commentary and real-world insights from physicians and researchers to understand market receptivity and refine your commercialization strategy.

3. Optimize Clinical Development & Market Access:

Benchmark your clinical strategy against competitors. Identify regulatory trends and payer expectations to design more successful trials and gain faster approvals.

4. Discover M&A and Licensing Opportunities:

Identify high-potential assets and companies for partnership or acquisition. Stay alert to undervalued pipeline drugs with market-shifting potential.

5. Custom-Tailored Insights:

Unlike generic reports, our analysis is aligned with your therapeutic focus and business needs—whether you’re scouting opportunities or defending market share.

Read More CI RDs:

1. Fabry Disease | Competitive Intelligence

2. Hemophilia B | Competitive Intelligence

Sai Kiran

DataM Intelligence 4market Research LLP

877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Distribution channels: Healthcare & Pharmaceuticals Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release