Fortified Beverages Market To Surpass USD 13.4 Billion by 2032

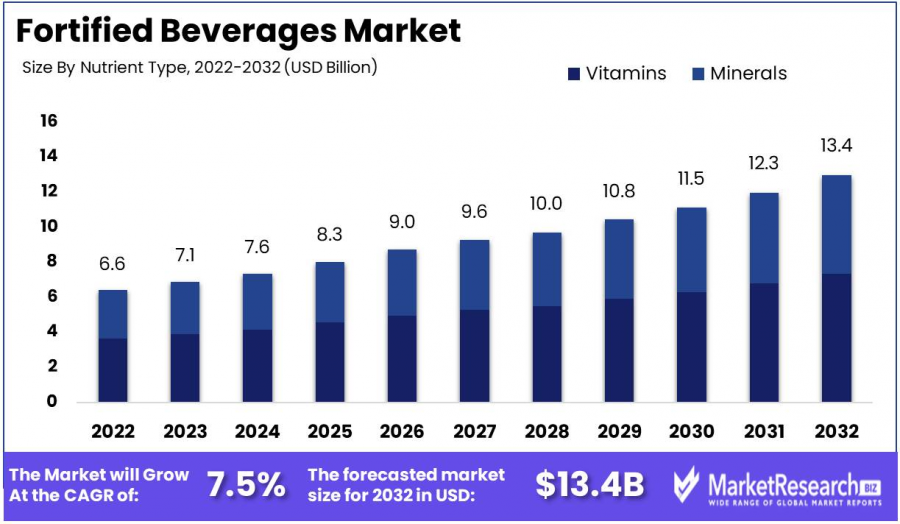

Fortified Beverages Market size is expected to be worth around USD 13.4 Bn by 2032 from USD 6.6 Bn in 2022, growing at a CAGR of 7.5% from 2023 to 2032.

NEW YORK, NY, UNITED STATES, February 7, 2025 /EINPresswire.com/ -- The Fortified Beverages Market, encompassing products enriched with nutrients such as vitamins and minerals, has seen substantial growth attributed to rising health consciousness and an increasing global population. Valued at USD 6.6 billion in 2022, the market is projected to reach USD 13.4 billion by 2032, with a CAGR of 7.5%. Fortified beverages provide a health-focused alternative to traditional nutrient-deficient drinks, offering a spectrum of products ranging from teas to energy drinks that cater to a health-conscious consumer base. Technological innovations in product development have expanded consumer options and enhanced product appeal. With fortified beverages gaining traction across supermarkets and retail channels, their popularity is set to rise further, particularly as consumers continue to prioritize health and wellness.

➤ 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐑𝐞𝐪𝐮𝐞𝐬𝐭: 𝐔𝐧𝐥𝐨𝐜𝐤 𝐕𝐚𝐥𝐮𝐚𝐛𝐥𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://marketresearch.biz/report/fortified-beverages-market/request-sample/

Experts Review

Government Incentives & Technological Innovations: Government initiatives promoting nutrition could bolster the market, while technological advancements enhance nutrient bioavailability. Investment Opportunities & Risks: Investors may benefit from the growing demand but must navigate competition with traditional beverages. Consumer Awareness: Health awareness drives market growth, though overcoming negative perceptions of artificial ingredients remains vital. Technological Impact: Bioavailability enhancements and clean-label production foster market appeal. Regulatory Environment: Regulations ensuring safety and efficacy of fortified products may shape market practices.

Report Segmentation

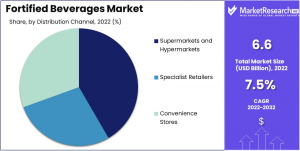

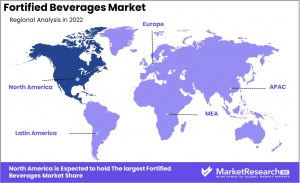

The market is segmented by nutrient type, product type, and distribution channel. By nutrient type, it includes vitamins and minerals, with vitamins being predominant due to health benefits. Product types are categorized into alcoholic and non-alcoholic, with non-alcoholic taking precedence due to its alignment with health and wellness trends. Distribution channels encompass supermarkets, hypermarkets, specialist retailers, and more, with supermarkets holding the largest share due to their convenience in consumer purchase behavior. Regionally, North America leads the market, backed by strong consumer health awareness and lifestyle changes, followed by emergent economies in Asia and Africa showing robust growth potential.

Key Market Segments

By Nutrient Type

• Vitamins

• Minerals

• Other Nutrient Types

By Product Type

• Non-Alcoholic

• Alcoholic

By Distribution Channel

• Supermarkets and Hypermarkets

• Specialist Retailers

• Convenience Stores

• Other Distribution Channels

➤ 𝐁𝐮𝐲 𝐍𝐨𝐰 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐩𝐨𝐫𝐭 𝐭𝐨 𝐆𝐫𝐨𝐰 𝐲𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬: https://marketresearch.biz/purchase-report/?report_id=37595

Drivers, Restraints, Challenges, and Opportunities

Drivers: Increased health consciousness and technological advancements in nutrient bioavailability are key drivers. Restraints: Challenges include maintaining authentic taste and overcoming established consumer loyalty to traditional beverages. Challenges: Distribution hurdles, particularly in underdeveloped regions, and the perception of artificial constituents pose significant challenges. Opportunities: Innovative formulations targeting specific demographics such as children and seniors, and the development of products using bioavailable natural ingredients present promising growth prospects.

Key Player Analysis

Major players like Nestle, PepsiCo, Coca-Cola, and Danone dominate the market, each leveraging extensive distribution networks and brand recognition to maintain market leadership. Nestle capitalizes on a broad product range, while PepsiCo focuses on expanding its healthy beverage portfolio. Coca-Cola uses its global brand strength to compete in diverse segments, and Danone targets health-conscious markets with its functional beverage offerings. GlaxoSmithKline and Campbell Soup Company also play crucial roles with specialized product lines.

• PepsiCo

• Nestle, SA

• The Coca-Cola Company

• CG Roxane, LLC

• Tempo Beverage Ltd

• The Kraft Heinz Company

• Campbell Soup Company

• Dr Pepper/Seven Up, Inc

• Tropicana Products Inc

• Other

Recent Developments

Recent developments include Coca-Cola’s introduction of nutrient-specific fortified beverages in 2021, offering healthier alternatives across drink categories. PepsiCo’s 2022 acquisition of SoBe LifeWater, a fortified water brand, reflects its strategic effort to enhance its fortified beverage offerings. Additionally, Keurig Dr Pepper’s planned 2023 launch of fortified coffee drinks underscores ongoing innovation efforts to appeal to health-focused consumers.

Conclusion

The Fortified Beverages Market is poised for sustained growth as consumers increasingly prioritize health and nutrition. With advancements in technology and continuous innovation by industry leaders, the market is well-positioned to tap into emergent opportunities and address evolving consumer preferences, driving its future expansion.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Food & Beverage Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release